When you need to manage your account money…pay your bills… even send money to another person… you shouldn’t have to juggle multiple apps or websites to get it all done. BillPay is the one central hub where you can take care of your payments from anywhere – on any device, anytime you like.

You can do this ANYTIME and ANYWHERE and for FREE.

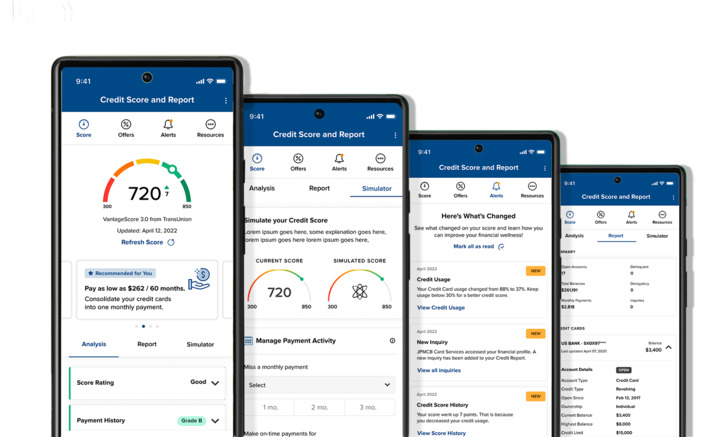

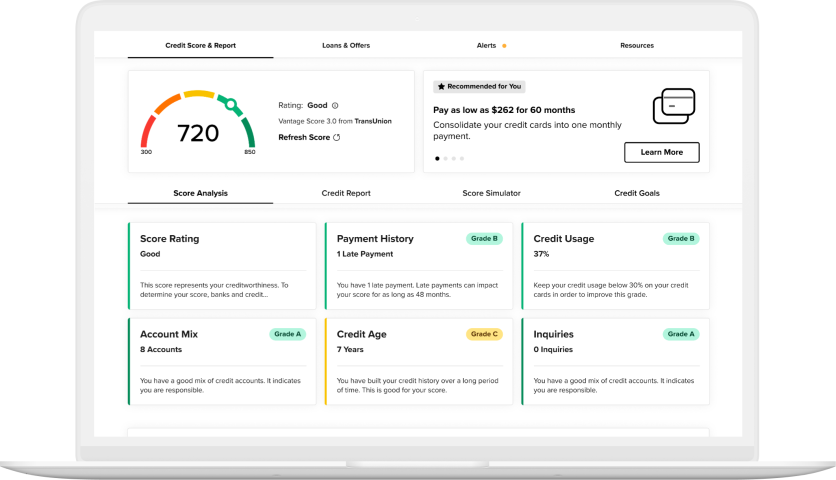

We’re committed to empowering individuals like yourself to take charge of their financial journeys. Whether buying a house, a car, or anything requiring a loan, or if you’re going to rent a new apartment or improve your overall creditworthiness, Credit Score can help you.

A credit score is a three-digit number calculated to indicate your creditworthiness. The higher the score, the more creditworthy you are to a lender. A credit score is calculated from the information in your credit report and considers your on-time payments, the length of your payment history, your mix of different types of credit accounts, and other such factors. It is important to know that your score does not take your age, income, employment, martial status, or your bank account balances into account.

VantageScore® was founded by the 3 leading credit reporting agencies – Experian, Equifax, and TransUnion. This credit score model was developed by a representative team of statisticians, analysts, and credit date experts from each of the credit reporting companies, and is used by hundreds of institutions, including credit unions, banks, credit cards issuers, and mortgage lenders.

The VantageScore® 3.0, the score that is shown in SavvyMoney, is a newer and more popular version of VantageScore®. It is calculated on a scale of 300-850, with 300 being the lowest and 850 the highest score

Five major categories make up a credit score:

Every 7 days scores are updated and displayed in digital banking. Users can also refresh their score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard with digital banking.

Federally Insured by NCUA and an Equal Housing Lender. We do business in accordance with the Fair Housing and Equal Credit Opportunity Act. NMLS #464571

*APR = Annual Percentage Rate. Rate based on creditworthiness and term of loan.

**APY = Annual Percentage Yield. Rates are subject to change at any time and are not guaranteed.

We may provide links to third party websites. The Credit Union has no control over any other website and is not responsible for the content, accessibility or security of any site other than this one. Users assume all responsibility when they go to other sites via the links on this page.

Notice: The linked site is not owned or controlled by the credit union, the credit union is not responsible for the availability, content or security of the linked site, the credit union is not responsible for any claims related to any goods or services obtained from the linked site, the linked site's privacy policies may differ from those of the credit union and the credit union is not responsible for compliance with those policies.